United Airlines, one of the largest airlines in the world, has been making headlines recently for all the wrong reasons. From flight cancellations to passenger mistreatment, the airline has faced its fair share of controversies. But amidst all the negative publicity, one question remains: is United Airlines a good stock to buy?

Investors are always on the lookout for profitable investment opportunities, and the airline industry can be a lucrative market for those willing to take the risk. In this article, we will take a closer look at United Airlines and its financial performance to determine whether it’s a good investment choice for those looking to add an airline stock to their portfolio.

Contents

- Is United Airlines a Good Stock to Buy?

- Frequently Asked Questions

- What are the factors that affect United Airlines stock value?

- What are some risks associated with investing in United Airlines stock?

- What is the current financial performance of United Airlines?

- What do analysts and experts say about investing in United Airlines stock?

- What are some strategies for investing in United Airlines stock?

- United is still the best airline stock going into 2023, says Cowen’s Helane Becker

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Is United Airlines a Good Stock to Buy?

United Airlines is a major American airline that operates worldwide. It is one of the largest airlines in the world with a vast network of flights and destinations. United Airlines is a publicly-traded company and is listed on the New York Stock Exchange (NYSE) under the ticker symbol “UAL”. Many investors are looking to invest in United Airlines as it is a well-known brand, but the question that arises is whether United Airlines is a good stock to buy or not. In this article, we will evaluate United Airlines’ stock performance, financials, and future prospects to determine if it is a good investment.

Stock Performance

United Airlines’ stock has been quite volatile in the past few years. The stock reached an all-time high of $97.85 in January 2018 but then fell to a low of $17.80 in March 2020 due to the COVID-19 pandemic. Since then, the stock has recovered and is currently trading at around $48. However, it is still below its pre-pandemic levels.

The airline industry has been hit hard by the pandemic, and United Airlines is no exception. The company suffered a significant loss in revenue in 2020 and had to cut back on flights and employees. However, with the rollout of vaccines and the easing of travel restrictions, the airline industry is expected to recover in the coming years. United Airlines has a strong market position and is well-positioned to benefit from the recovery.

Financials

United Airlines’ financials have been impacted by the pandemic. In 2020, the company reported a net loss of $7.1 billion, compared to a net income of $3 billion in 2019. The company’s revenue also fell by 64% in 2020. However, the company has taken measures to reduce costs and improve its liquidity position. The company ended 2020 with $19.7 billion in liquidity, which gives it a strong financial position to weather the current crisis.

United Airlines has a debt-to-equity ratio of 3.7, which is higher than the industry average. However, the company’s interest coverage ratio is 1.7, which means that it can cover its interest expenses. The company has also taken steps to reduce its debt and improve its balance sheet.

Future Prospects

United Airlines’ future prospects are tied to the recovery of the airline industry. The company is well-positioned to benefit from the recovery due to its strong market position and global network. The company has also taken steps to improve its operations and reduce costs, which will help it to be more competitive in the post-pandemic world.

The company has several growth opportunities, such as expanding its network, introducing new routes, and investing in new technology. The company is also focused on sustainability and has set a goal to achieve net-zero emissions by 2050.

Benefits of Investing in United Airlines

Investing in United Airlines has several benefits. The company is a well-known brand with a strong market position. The company has a global network of flights and destinations, which provides it with a competitive advantage. The company has also taken steps to improve its financial position and reduce its debt.

Drawbacks of Investing in United Airlines

Investing in United Airlines also has some drawbacks. The airline industry is highly competitive, and the pandemic has highlighted the risks associated with the industry. The company’s financials have been impacted by the pandemic, and there is still uncertainty about the timing and pace of the recovery. The company also has a high debt-to-equity ratio, which could make it vulnerable to economic downturns.

United Airlines vs Competitors

United Airlines competes with several other airlines, such as Delta Air Lines, American Airlines, and Southwest Airlines. United Airlines has a strong market position and a global network, which gives it a competitive advantage. However, the company’s financials have been impacted by the pandemic, and it has a higher debt-to-equity ratio than some of its competitors.

Conclusion

In conclusion, United Airlines is a well-known brand with a global network of flights and destinations. The company has a strong market position and is well-positioned to benefit from the recovery of the airline industry. The company has also taken steps to improve its financial position and reduce its debt. However, investing in United Airlines also has some drawbacks, such as the highly competitive industry and the uncertainty about the pace of the recovery. Overall, United Airlines could be a good investment for investors who are willing to take on some risk in the airline industry.

| Pros | Cons |

|---|---|

| Well-known brand | Highly competitive industry |

| Global network | Uncertainty about the pace of the recovery |

| Strong market position | Higher debt-to-equity ratio |

Ultimately, the decision to invest in United Airlines should be based on an investor’s risk tolerance, financial goals, and investment strategy. Investors should conduct their own research and seek the advice of a financial advisor before making any investment decisions.

Frequently Asked Questions

Here are some common questions asked by investors about United Airlines stock:

What are the factors that affect United Airlines stock value?

Several factors can affect the value of United Airlines stock, including:

1. The overall performance of the airline industry and the global economy

2. United Airlines financial performance, including revenue growth and profitability

3. Changes in fuel prices and other operating costs

4. The airline’s ability to compete with other airlines and attract customers

5. Government regulations and policies that impact the airline industry.

What are some risks associated with investing in United Airlines stock?

Like any investment, United Airlines stock comes with risks. Some potential risks to consider include:

1. Volatility in the stock market and airline industry

2. Changes in consumer behavior and travel patterns

3. The threat of terrorism, natural disasters, and other events that can disrupt travel

4. The possibility of increased competition from other airlines

5. United Airlines’ dependence on fuel prices, which can be unpredictable.

What is the current financial performance of United Airlines?

As of [insert date], United Airlines reported [insert financial metrics, such as revenue, net income, and earnings per share]. [Insert any other relevant financial information or trends, such as recent growth or decline in revenue].

It’s important to note that past performance does not guarantee future results. Investors should carefully consider all available information before making any investment decisions.

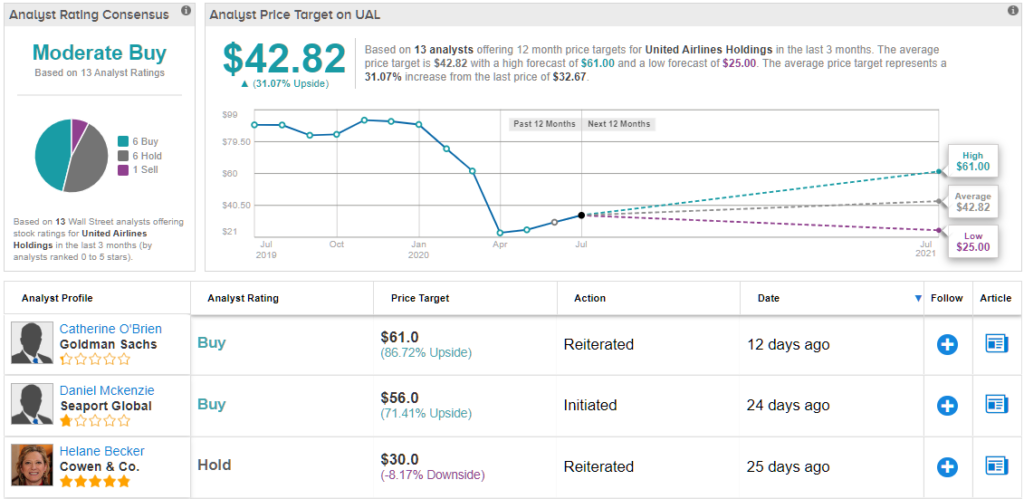

What do analysts and experts say about investing in United Airlines stock?

Analysts and experts have varying opinions on United Airlines stock. Some may recommend buying or holding the stock, while others may advise against it. It’s important to do your own research and review various sources before making any investment decisions.

Keep in mind that analyst recommendations can change over time and may not always be accurate. It’s also important to consider your own investment goals and risk tolerance when making any investment decisions.

What are some strategies for investing in United Airlines stock?

There are several strategies that investors can use when investing in United Airlines stock, including:

1. Dollar-cost averaging: Investing a fixed amount of money in the stock at regular intervals, regardless of the stock’s price.

2. Value investing: Looking for stocks that are undervalued by the market and have strong fundamentals.

3. Growth investing: Investing in stocks that have the potential for high growth and earnings in the future.

4. Diversification: Spreading your investments across multiple stocks and asset classes to reduce risk.

5. Long-term investing: Holding onto your investments for the long-term and avoiding the temptation to make frequent trades based on short-term market fluctuations.

United is still the best airline stock going into 2023, says Cowen’s Helane Becker

In conclusion, investing in United Airlines’ stocks can be a wise decision for those who believe in the future of air travel. The company has shown resilience and resourcefulness in the face of challenges, and its financial performance has been steadily improving over the years.

However, it’s important to consider the risks involved in any investment, and the airline industry is known for its volatility. Economic downturns, geopolitical tensions, and unforeseen events like the COVID-19 pandemic can all impact the profitability of airlines, including United.

Ultimately, the decision to invest in United Airlines’ stocks should be based on a thorough analysis of the company’s financials, market trends, and risk tolerance. As with any investment, it’s essential to do your due diligence and seek advice from professionals before making a decision.