United Airlines is a major player in the aviation industry and offers a range of services to make traveling a comfortable experience for its passengers. One of the services they offer is travel insurance, which is designed to protect travelers from unforeseen circumstances that may arise before or during their trip. But is United Airlines insurance worth it? Let’s explore the benefits and drawbacks of this service to help you make an informed decision before purchasing.

Is United Airlines Insurance Worth It?

If you’re planning a trip with United Airlines, you may have come across the option to purchase travel insurance at the time of booking. This can be a tempting offer, as it promises to protect you from any unexpected events that may arise before or during your trip. But is United Airlines insurance worth it? In this article, we’ll explore the pros and cons of purchasing travel insurance from United Airlines.

What Does United Airlines Insurance Cover?

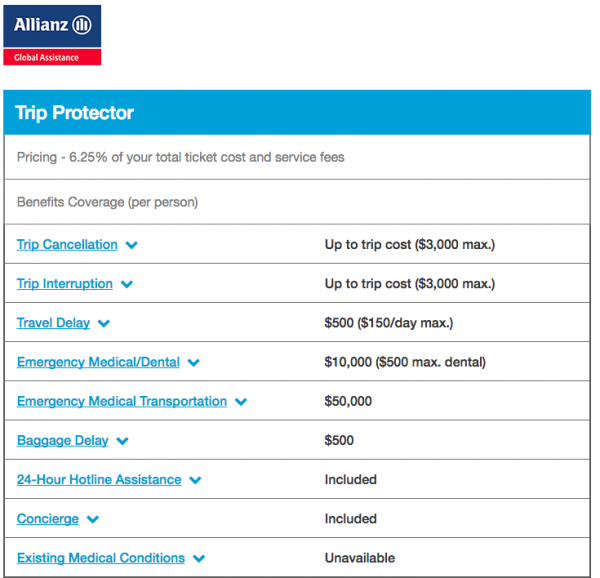

United Airlines offers two types of travel insurance: Trip Protection and Trip Protection Plus. Trip Protection covers trip cancellation, trip interruption, and trip delay, while Trip Protection Plus also covers baggage delay, lost or stolen baggage, and medical and dental emergencies.

With Trip Protection, you’ll be covered if you need to cancel your trip due to a covered reason, such as illness, injury, or inclement weather. You’ll also be covered if your trip is interrupted for a covered reason, such as a natural disaster or a family emergency. If your flight is delayed for more than six hours, you can be reimbursed for expenses such as meals and lodging.

With Trip Protection Plus, you’ll have all of the same coverage as Trip Protection, plus additional coverage for baggage delay, lost or stolen baggage, and medical and dental emergencies. If your baggage is delayed for more than six hours, you can be reimbursed for expenses such as clothing and toiletries. If your baggage is lost or stolen, you can be reimbursed up to a certain amount.

The Pros of United Airlines Insurance

There are several benefits to purchasing travel insurance from United Airlines. First and foremost, it can give you peace of mind knowing that you’re protected from unexpected events that may arise before or during your trip. If you need to cancel your trip or if your flight is delayed or interrupted, you can be reimbursed for any expenses you’ve incurred.

Another benefit of United Airlines insurance is that it’s easy to purchase. You can add it to your booking online or over the phone, and you can choose the level of coverage that’s right for you. If you’re traveling with expensive items, such as a laptop or camera, the extra coverage provided by Trip Protection Plus may be worth it.

The Cons of United Airlines Insurance

While there are benefits to purchasing travel insurance from United Airlines, there are also some drawbacks to consider. One of the biggest drawbacks is the cost. United Airlines insurance can be expensive, especially if you opt for the higher level of coverage provided by Trip Protection Plus.

Another drawback to United Airlines insurance is that it may not cover everything you need it to. For example, if you have a pre-existing medical condition, it may not be covered under the policy. It’s important to read the fine print and understand exactly what is and isn’t covered before purchasing travel insurance from United Airlines.

Is United Airlines Insurance Worth It?

So, is United Airlines insurance worth it? The answer depends on your individual circumstances. If you’re traveling with expensive items or if you’re concerned about the possibility of trip cancellation or interruption, United Airlines insurance may be worth the cost. However, if you’re traveling on a tight budget or if you don’t have any concerns about potential travel issues, it may not be necessary.

Ultimately, the decision to purchase travel insurance from United Airlines is a personal one. It’s important to weigh the pros and cons and decide what level of coverage is right for you. If you do decide to purchase travel insurance from United Airlines, be sure to read the fine print and understand exactly what is and isn’t covered under the policy.

Contents

- Frequently Asked Questions

- What is United Airlines Insurance?

- What does United Airlines Insurance cover?

- How much does United Airlines Insurance cost?

- Is United Airlines Insurance worth it?

- How do I purchase United Airlines Insurance?

- Is United Airlines Travel Insurance Worth Buying – AARDY

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Frequently Asked Questions

What is United Airlines Insurance?

United Airlines offers various insurance options to protect passengers against trip cancellations, trip interruptions, and other unforeseen circumstances. These insurance options are designed to provide peace of mind and financial protection in case of unexpected events.

United Airlines Insurance can cover trip cancellations, medical emergencies, lost or delayed baggage, and other travel-related issues. The insurance options vary depending on the type of trip and destination, so it’s important to carefully review the terms and conditions before purchasing.

What does United Airlines Insurance cover?

United Airlines Insurance typically covers trip cancellations, trip interruptions, medical emergencies, lost or delayed baggage, and other travel-related issues. The coverage and benefits depend on the specific insurance option chosen by the passenger.

For example, the Trip Cancellation and Trip Interruption insurance can provide reimbursement for non-refundable expenses if a trip is cancelled or interrupted due to a covered reason, such as an illness or severe weather. The medical insurance can cover emergency medical expenses while traveling, and the baggage insurance can provide reimbursement for lost or delayed baggage.

How much does United Airlines Insurance cost?

The cost of United Airlines Insurance depends on the type of insurance option chosen by the passenger, as well as the cost and duration of the trip. The insurance options are typically priced as a percentage of the total trip cost.

For example, the Trip Cancellation and Trip Interruption insurance can cost around 5-10% of the total trip cost, while the medical and baggage insurance options may cost a few dollars per day of travel. It’s important to carefully review the cost and benefits of each insurance option before purchasing.

Is United Airlines Insurance worth it?

Whether or not United Airlines Insurance is worth it depends on the individual traveler’s needs and preferences. Passengers who are traveling with expensive items or who may be at risk of trip cancellations or interruptions may find the insurance options to be worthwhile.

However, passengers who are traveling on a budget or who have flexibility in their travel plans may not find the insurance options to be necessary. It’s important to carefully review the terms and conditions of each insurance option and consider the potential risks and benefits before making a decision.

How do I purchase United Airlines Insurance?

United Airlines Insurance can be purchased online through the United Airlines website or through a travel agent. Passengers can select the insurance options they want during the booking process or add them later through their reservation.

It’s important to carefully review the terms and conditions of each insurance option before purchasing and to keep a copy of the insurance policy and contact information in case of emergency.

Is United Airlines Travel Insurance Worth Buying – AARDY

In conclusion, whether or not United Airlines insurance is worth it ultimately depends on your individual circumstances and the type of trip you’re taking. If you’re traveling internationally or have a more expensive ticket, it may be worth considering purchasing insurance to protect your investment.

However, if you’re taking a short domestic trip or have a lower-priced ticket, the added cost of insurance may not be necessary. It’s important to carefully read through the policy and understand what is and isn’t covered before making a decision.

Ultimately, the decision to purchase United Airlines insurance is a personal one. Weigh the potential risks and benefits and make the best decision for your unique situation. Whatever you choose, make sure you have a safe and enjoyable trip!