United Airlines is one of the most popular airlines in the United States, serving millions of passengers each year. As an investor, you may be wondering if it’s worth investing in United Airlines stock. One question that often comes up is whether United Airlines pays dividends to its shareholders. In this article, we will explore this topic and provide you with the information you need to make informed investment decisions.

Does United Airlines Stock Pay Dividends?

United Airlines is one of the largest airlines in the world. It has a market capitalization of over $17 billion and is a component of the S&P 500 index. Many investors are interested in the stock of United Airlines, but one question that often arises is whether the company pays dividends or not. In this article, we will explore this question and provide you with all the information you need to know about United Airlines’ dividend policy.

United Airlines’ Dividend Policy

United Airlines does not currently pay dividends to its shareholders. The company stopped paying dividends in 2002, and since then, it has not resumed paying them. This means that if you buy United Airlines’ stock, you will not receive any regular dividend payments.

There are several reasons why companies choose not to pay dividends. One reason is that they prefer to reinvest their profits back into the business to fuel growth. Another reason is that they may want to keep their cash reserves high for future opportunities or to weather economic downturns.

Benefits of Dividend-Paying Stocks

Although United Airlines does not currently pay dividends, there are many benefits to investing in dividend-paying stocks. Dividend-paying stocks can provide a steady stream of income for investors, which can be especially important for those who rely on their investments for their retirement income.

In addition to providing income, dividend-paying stocks can also be less volatile than non-dividend-paying stocks. This is because companies that pay dividends are often more established and have a proven track record of financial stability.

United Airlines vs. Other Airlines

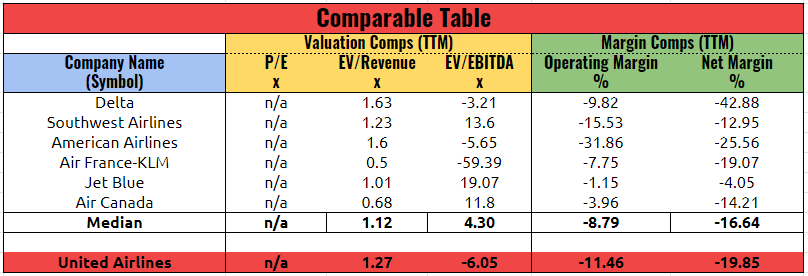

When comparing United Airlines to other airlines, it is worth noting that many other airlines also do not pay dividends. For example, Delta Air Lines, American Airlines, and Southwest Airlines do not currently pay dividends to their shareholders.

However, there are some airlines that do pay dividends. For example, Alaska Air Group currently pays a dividend yield of 0.9%, and Air Canada pays a dividend yield of 0.4%. If you are specifically interested in investing in an airline that pays dividends, you may want to consider these options.

Conclusion

In summary, United Airlines does not currently pay dividends to its shareholders. While this may be disappointing for some investors, it is important to remember that there are many other benefits to investing in stocks, including potential capital appreciation and a diversified portfolio. If you are interested in investing in United Airlines, be sure to do your research and consider all of your options before making a decision.

Contents

- Frequently Asked Questions

- 1. What is a dividend?

- 2. Does United Airlines pay dividends?

- 3. What factors can affect a company’s decision to pay dividends?

- 4. Are there any alternatives to dividends for generating income from stocks?

- 5. Should dividend payments be a key consideration when investing in stocks?

- United Airlines stock rises on BNP Paribas upgrade

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Frequently Asked Questions

1. What is a dividend?

A dividend is a payment made by a corporation to its shareholders, usually in the form of cash or additional shares of stock. Dividends are typically paid out of a company’s profits, and are usually distributed on a regular basis, such as quarterly or annually.

Dividends can be a way for investors to generate income from their investments, and can also be seen as a sign of financial health and stability for the issuing company.

2. Does United Airlines pay dividends?

As of September 2021, United Airlines does not pay dividends on its common stock. The company has not paid dividends since 2019, when it suspended its dividend program due to the financial impact of the COVID-19 pandemic on the airline industry.

United Airlines has stated that it may consider resuming its dividend program in the future, but no official announcement has been made at this time.

3. What factors can affect a company’s decision to pay dividends?

Several factors can influence a company’s decision to pay dividends, including its financial performance and profitability, cash flow, debt levels, and future growth prospects. Companies that are experiencing financial difficulties or investing heavily in growth initiatives may choose to suspend or reduce their dividend payments in order to conserve cash and reinvest in the business.

Other factors, such as changes in tax laws or regulatory requirements, may also impact a company’s dividend policy.

4. Are there any alternatives to dividends for generating income from stocks?

Yes, there are several alternatives to dividends for generating income from stocks. One option is to sell a portion of your shares in the company, which can provide a source of cash flow while allowing you to retain ownership in the company.

Another option is to invest in stocks that pay high yields, such as real estate investment trusts (REITs) or utility companies. These types of stocks are often seen as income-generating investments, and can provide a steady stream of cash flow through dividend payments.

5. Should dividend payments be a key consideration when investing in stocks?

While dividend payments can be a valuable source of income for investors, they should not be the sole focus when investing in stocks. Other factors, such as a company’s financial health, growth prospects, and valuation, should also be taken into account when evaluating potential investments.

Additionally, investors should consider their own financial goals and risk tolerance when selecting stocks, and should seek the advice of a financial professional if they are unsure about how to allocate their investments.

United Airlines stock rises on BNP Paribas upgrade

In conclusion, United Airlines does not currently pay dividends to its stockholders. While this may seem disappointing to some investors, it is important to remember that dividend payments are not the only way in which a company can provide value to its shareholders. United Airlines has instead chosen to reinvest its profits into the business to fuel growth and increase shareholder value over time.

It is worth noting that the decision to pay dividends is ultimately up to the company’s management and board of directors. They must weigh the benefits of dividend payments against other potential uses of the company’s funds, such as investing in research and development, expanding operations, or paying down debt.

Investors considering United Airlines stock should carefully evaluate the company’s financial performance, growth prospects, and management strategy before making a decision. While the absence of dividends may be a factor to consider, it is just one of many factors that should be taken into account when evaluating an investment opportunity.