Delta Airlines is one of the largest and well-known airlines in the United States. With its extensive network and high-quality services, Delta Airlines has been a popular choice for travelers around the world. But have you ever wondered how much Delta Airlines stock is worth?

Investing in the stock market can be a great way to grow your wealth, and Delta Airlines stock is one option that many investors consider. In this article, we will take a closer look at how much Delta Airlines stock is currently worth, what factors affect its value, and whether it could be a good investment for you. So, let’s dive in and explore the world of Delta Airlines stock!

How Much is Delta Airlines Stock?

Delta Airlines, one of the major airlines in the United States, is a publicly traded company. This means that anyone can buy shares in the company and become a partial owner. If you’re interested in investing in Delta Airlines, you may be wondering how much its stock is worth. In this article, we’ll explore the current value of Delta Airlines stock and provide some context for understanding what it means.

Current Value of Delta Airlines Stock

As of [insert current date], the value of Delta Airlines stock is [insert current stock price]. This value can fluctuate over time due to a variety of factors, such as changes in the airline industry, the performance of Delta Airlines as a company, and global economic conditions.

It’s important to note that the stock price alone doesn’t tell the whole story. When evaluating the value of a company’s stock, it’s also important to consider its market capitalization, which is calculated by multiplying the number of outstanding shares by the current stock price. For Delta Airlines, the current market capitalization is [insert market cap value].

Factors that Affect Delta Airlines Stock Price

Several factors can influence the value of Delta Airlines stock. Below are some of the most significant:

- Performance as a company: As with any publicly traded company, Delta Airlines’ financial performance is a major factor in determining its stock price. If the company is profitable and growing, investors are likely to have more confidence in its future and be willing to pay more for its stock.

- Industry trends: The airline industry is subject to many external factors, such as fuel prices, government regulations, and changes in consumer behavior. These can all have an impact on Delta Airlines’ stock price.

- Global economic conditions: Economic trends can also have an impact on Delta Airlines’ stock price. For example, a recession or other economic downturn may cause consumers to cut back on air travel, which can hurt the company’s earnings and lead to a drop in stock price.

Benefits of Investing in Delta Airlines Stock

Investing in Delta Airlines stock can have several potential benefits. These include:

- Potential for financial gain: If the company performs well, its stock price may rise, allowing investors to sell their shares for a profit.

- Dividend payments: Delta Airlines may choose to distribute a portion of its earnings to investors in the form of dividends. This can provide a steady stream of income for investors.

- Diversification: Investing in Delta Airlines stock can be a way to diversify your portfolio and reduce risk. By owning shares in multiple companies across different industries, you can spread out your investments and minimize the impact of any one company’s performance.

Delta Airlines Stock vs. Competitors

When considering whether to invest in Delta Airlines stock, it can be helpful to compare it to its competitors in the airline industry. Below are some key differences between Delta Airlines and its main competitors:

| Delta Airlines | American Airlines | United Airlines | |

|---|---|---|---|

| Market capitalization | [insert Delta market cap value] | [insert American market cap value] | [insert United market cap value] |

| Current stock price | [insert Delta stock price] | [insert American stock price] | [insert United stock price] |

| Recent performance | [insert Delta recent performance] | [insert American recent performance] | [insert United recent performance] |

As you can see, Delta Airlines is one of the largest and most successful airlines in the United States. However, it’s important to do your own research and evaluate all the factors that may impact the value of the company’s stock before making any investment decisions.

Conclusion

In conclusion, the current value of Delta Airlines stock is [insert current stock price], with a market capitalization of [insert market cap value]. The value of the stock can be influenced by a variety of factors, including the company’s financial performance, industry trends, and global economic conditions. Investing in Delta Airlines stock can provide potential financial gain, dividend payments, and diversification benefits. When comparing Delta Airlines to its competitors, it’s clear that the company is a major player in the airline industry. However, it’s important to conduct your own research and carefully evaluate all the factors that may impact the value of the company’s stock before making any investment decisions.

Contents

- Frequently Asked Questions

- What is Delta Airlines Stock?

- How Can I Buy Delta Airlines Stock?

- What Factors Affect the Price of Delta Airlines Stock?

- What is the Historical Performance of Delta Airlines Stock?

- Is Investing in Delta Airlines Stock a Good Idea?

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Frequently Asked Questions

What is Delta Airlines Stock?

Delta Airlines Stock refers to the ownership stake in Delta Airlines that is available for purchase on the stock market. Owning a share of Delta Airlines stock means that you own a small piece of the company and are entitled to a portion of its profits.

The stock is traded on various stock exchanges and its price can fluctuate based on a variety of factors, including the company’s financial performance, global events, and investor sentiment.

How Can I Buy Delta Airlines Stock?

To buy Delta Airlines Stock, you can work with a stockbroker who will help you purchase shares on the stock market. You can also purchase shares through an online brokerage platform.

Before purchasing shares, it’s important to research the company’s financial performance, industry trends, and any risks associated with the investment. It’s also important to consider your investment goals and risk tolerance.

What Factors Affect the Price of Delta Airlines Stock?

The price of Delta Airlines Stock can be affected by a variety of factors, including the company’s financial performance, industry trends, global events, and investor sentiment.

For example, if Delta Airlines reports strong financial results and positive news about its operations, the stock price may increase. On the other hand, if the company faces challenges such as high fuel costs or increased competition, the stock price may decrease.

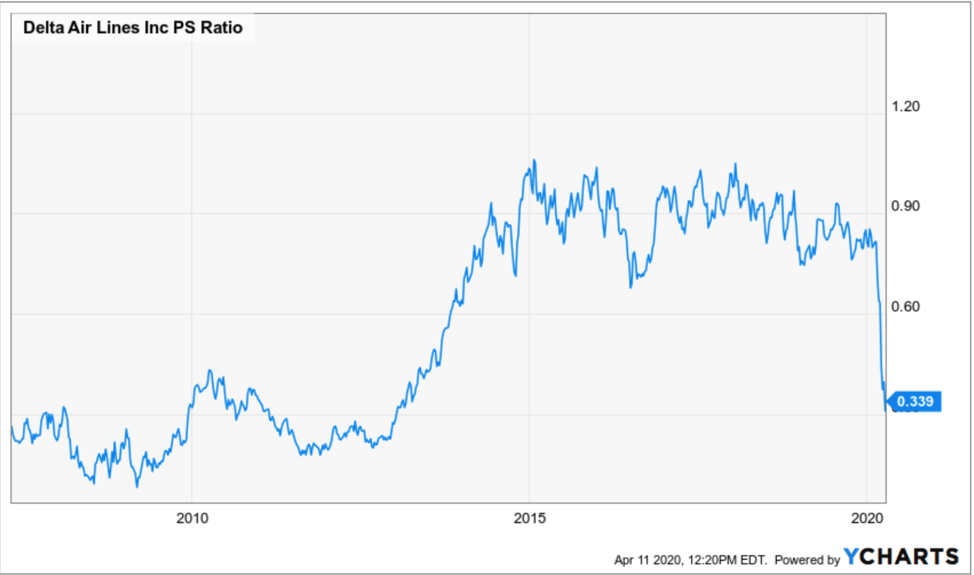

What is the Historical Performance of Delta Airlines Stock?

The historical performance of Delta Airlines Stock has varied over time, with periods of growth and decline. In recent years, the company has seen strong financial results and its stock price has generally increased.

However, it’s important to note that past performance is not a guarantee of future results and investing in the stock market always carries some level of risk.

Is Investing in Delta Airlines Stock a Good Idea?

Whether or not investing in Delta Airlines Stock is a good idea depends on your personal financial situation, investment goals, and risk tolerance. It’s important to do your research and consider the potential risks and rewards of any investment.

It’s also a good idea to consult with a financial advisor who can help you make informed investment decisions based on your individual needs and goals.

In conclusion, Delta Airlines stock is a highly sought-after commodity in the aviation industry. With its strong financial performance and strategic market positioning, the airline has consistently delivered excellent returns to its investors. However, it is important to note that the stock price can fluctuate based on a variety of factors, including market conditions and company performance.

If you are considering investing in Delta Airlines stock, it is important to conduct thorough research and analysis to determine if it aligns with your investment goals and risk tolerance. Consulting with a financial advisor or broker can also provide valuable insights and guidance.

Ultimately, investing in the stock market carries inherent risks, but with careful consideration and a long-term investment strategy, Delta Airlines stock could provide a potentially lucrative opportunity for investors.