Delta Airlines is one of the major players in the aviation industry, with a strong global presence and a long history of serving customers. However, investors are often curious whether Delta Airlines is a good stock to buy. With the airline industry being hit hard by the pandemic, this question becomes even more relevant. In this article, we will explore the current state of Delta Airlines and the factors that make it a compelling investment opportunity.

Contents

- Is Delta Airlines a Good Stock to Buy?

- Frequently Asked Questions

- What are the factors that contribute to Delta Airlines’ stock performance?

- What are the advantages of investing in Delta Airlines’ stock?

- What are the risks associated with investing in Delta Airlines’ stock?

- What is Delta Airlines’ current financial position?

- Should I buy Delta Airlines’ stock?

- Delta is a good stock to own: Jim Lebenthal

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Is Delta Airlines a Good Stock to Buy?

Delta Airlines is one of the major players in the airline industry, providing services domestically and internationally. But with the COVID-19 pandemic affecting the travel industry, many investors are wondering if Delta Airlines is still a good stock to buy. In this article, we will take a closer look at Delta Airlines to help you make an informed decision.

Overview of Delta Airlines

Delta Airlines is one of the largest airlines in the world, with a fleet of over 800 aircraft and serving more than 300 destinations. The company has a strong reputation for customer service and has won numerous awards for its performance. Delta Airlines has also been a leader in the industry in terms of fuel efficiency and sustainability.

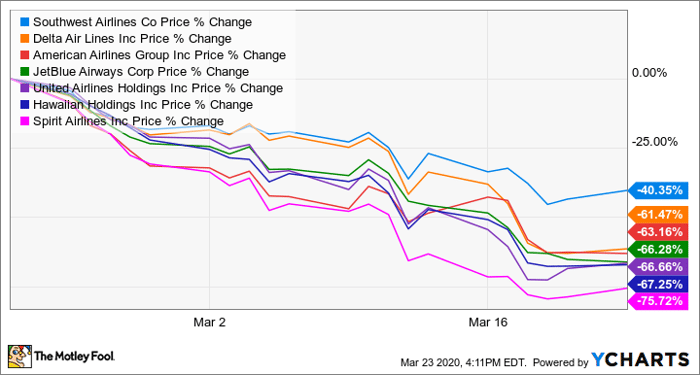

Delta Airlines has been hit hard by the COVID-19 pandemic, with a significant reduction in air travel resulting in a substantial loss of revenue. However, the company has taken steps to mitigate the impact, including reducing capacity and cutting costs. Delta Airlines has also received government assistance to help weather the storm.

Financial Performance

Delta Airlines’ financial performance has been impacted by the COVID-19 pandemic, with the company reporting a net loss of $12.4 billion in 2020. However, the company has a strong balance sheet and has taken steps to preserve cash and reduce costs. Delta Airlines expects to return to profitability as air travel rebounds.

In terms of valuation, Delta Airlines’ stock currently trades at a price-to-earnings ratio of 3.59, which is significantly lower than the industry average of 15.57. This suggests that the stock may be undervalued, making it an attractive investment opportunity.

Industry Trends

The airline industry has been heavily impacted by the COVID-19 pandemic, with a significant reduction in air travel demand. However, as vaccination rates increase and travel restrictions ease, there is hope that air travel will rebound. Delta Airlines has positioned itself to take advantage of this rebound by reducing capacity and cutting costs.

In addition, the airline industry is facing pressure to reduce its environmental impact, and Delta Airlines has been a leader in this area. The company has set a goal to become carbon neutral by 2050 and has invested in sustainable aviation fuels and other initiatives to reduce its carbon footprint.

Benefits of Investing in Delta Airlines

Investing in Delta Airlines has several benefits, including:

– Undervalued stock: Delta Airlines’ stock is currently trading at a low price-to-earnings ratio, suggesting that it may be undervalued.

– Strong balance sheet: Despite the impact of the COVID-19 pandemic, Delta Airlines has a strong balance sheet, which provides a solid foundation for future growth.

– Industry leader in sustainability: Delta Airlines is a leader in the airline industry when it comes to sustainability, which is becoming increasingly important to consumers and investors.

Challenges of Investing in Delta Airlines

Investing in Delta Airlines also comes with some challenges, including:

– Uncertainty around air travel demand: The COVID-19 pandemic has created significant uncertainty around air travel demand, which could impact Delta Airlines’ financial performance in the short term.

– Competitive industry: The airline industry is highly competitive, with many players vying for market share. This could impact Delta Airlines’ ability to grow and compete.

Delta Airlines vs. Competitors

When comparing Delta Airlines to its competitors, there are several factors to consider. Delta Airlines has a strong reputation for customer service and sustainability, which could give it an advantage over competitors. However, the airline industry is highly competitive, and Delta Airlines faces stiff competition from other major players such as American Airlines and United Airlines.

In terms of financial performance, Delta Airlines has a lower price-to-earnings ratio than its competitors, which could make it an attractive investment opportunity.

Conclusion

Overall, Delta Airlines is a well-established player in the airline industry with a strong reputation for customer service and sustainability. While the COVID-19 pandemic has impacted the company’s financial performance, Delta Airlines has taken steps to mitigate the impact and position itself for future growth. With a low price-to-earnings ratio and a strong balance sheet, Delta Airlines may be an attractive investment opportunity for those looking to invest in the airline industry. However, the industry is highly competitive, and there is uncertainty around air travel demand, which could impact the company’s financial performance in the short term.

Frequently Asked Questions

What are the factors that contribute to Delta Airlines’ stock performance?

Delta Airlines’ stock performance is influenced by various factors such as the overall performance of the airline industry, the company’s financial health, and its competitive position in the market. The company’s revenue, earnings, and profitability are also critical indicators of its stock performance. Additionally, Delta Airlines’ ability to manage its costs, fuel prices, and labor expenses also affect its stock price.

What are the advantages of investing in Delta Airlines’ stock?

Delta Airlines has a strong track record of delivering consistent financial performance, even during challenging times. The company has a diversified revenue base and a competitive cost structure, which helps it to weather market fluctuations. Additionally, Delta Airlines has a robust balance sheet, which gives it the financial flexibility to invest in growth opportunities and return value to shareholders through dividends and share buybacks.

What are the risks associated with investing in Delta Airlines’ stock?

Like any investment, there are risks associated with investing in Delta Airlines’ stock. The airline industry is highly cyclical, and Delta Airlines’ stock price can be volatile. The company is also exposed to various external factors such as fuel prices, labor costs, and regulatory changes. Additionally, the ongoing COVID-19 pandemic has significantly impacted the airline industry, and the recovery timeline is uncertain.

What is Delta Airlines’ current financial position?

Delta Airlines has a strong financial position, with a healthy balance sheet and a solid cash position. The company reported a revenue of $17.1 billion and a net income of $2.6 billion in 2019. Despite the challenges posed by the COVID-19 pandemic, Delta Airlines has taken measures to conserve cash and reduce costs, which has helped to mitigate the impact on its financial position.

Should I buy Delta Airlines’ stock?

The decision to buy Delta Airlines’ stock depends on your investment goals, risk tolerance, and overall portfolio strategy. Delta Airlines has a strong track record of delivering consistent financial performance and has a robust balance sheet. However, the airline industry is highly cyclical and is currently facing significant headwinds due to the COVID-19 pandemic. It is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Delta is a good stock to own: Jim Lebenthal

In conclusion, investing in Delta Airlines can be a good decision for investors who are looking for a stable and reliable airline stock. The company has a strong market position, a solid financial performance, and a commitment to innovation and sustainability. However, as with any investment, there are risks to consider, such as the impact of external factors like fuel prices, competition, and regulatory changes.

With all of this in mind, it’s important to do your own research and analysis before making any investment decisions. Look at Delta’s financial statements, read analyst reports, and stay up-to-date on industry news and trends. By taking a thoughtful and informed approach, you can make a more confident decision about whether Delta Airlines is a good stock to buy for your portfolio.

Overall, Delta Airlines has proven to be a strong performer in the airline industry, with a track record of success and a commitment to innovation and sustainability. While there are risks to consider, investors who do their due diligence may find that Delta is a good stock to buy as part of a diversified portfolio. As always, it’s important to invest wisely and with a long-term perspective in order to achieve your financial goals.