Flying is one of the most convenient and fastest ways to travel, but it also comes with a certain level of risk. No one wants to think about the worst-case scenario when they’re planning a trip, but accidents can happen, and it’s important to be prepared. That’s where flight insurance comes in. But is it worth the extra cost? In this article, we’ll take a closer look at American Airlines’ flight insurance policy and help you decide if it’s right for you.

Contents

- Is Flight Insurance Worth It American Airlines?

- Frequently Asked Questions

- What does American Airlines Flight Insurance cover?

- How much does American Airlines Flight Insurance cost?

- Can I purchase American Airlines Flight Insurance after I’ve booked my trip?

- What happens if I need to cancel my trip after purchasing American Airlines Flight Insurance?

- Is American Airlines Flight Insurance worth it?

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Is Flight Insurance Worth It American Airlines?

If you’re planning a trip and have booked your flight with American Airlines, you may be wondering whether or not to purchase flight insurance. Flight insurance can provide peace of mind in case anything goes wrong, but it also comes at a cost. In this article, we’ll take a closer look at the benefits and drawbacks of purchasing flight insurance with American Airlines.

What is Flight Insurance?

Flight insurance is a type of travel insurance that specifically covers flight-related incidents. This can include trip cancellation or interruption, lost or delayed baggage, or medical emergencies that occur while traveling. When you purchase flight insurance, you’re essentially paying for coverage in case something goes wrong during your trip.

There are typically two types of flight insurance offered by American Airlines: trip insurance and travel protection. Trip insurance covers trip cancellation or interruption, while travel protection covers a wider range of incidents including trip cancellation or interruption, baggage loss, and medical emergencies.

The Benefits of Flight Insurance with American Airlines

There are several benefits to purchasing flight insurance with American Airlines. First and foremost, it provides peace of mind in case anything goes wrong during your trip. If you have to cancel your trip due to unforeseen circumstances, you’ll be able to recoup some or all of your costs depending on your coverage.

Flight insurance can also cover medical emergencies that occur while traveling. If you become sick or injured during your trip, your flight insurance can help cover the costs of medical treatment. This can be especially valuable if you’re traveling to a country with high medical costs.

Table: Benefits of Flight Insurance with American Airlines

| Benefit | Explanation |

|---|---|

| Peace of mind | Flight insurance provides reassurance in case anything goes wrong during your trip. |

| Financial protection | If you have to cancel your trip due to unforeseen circumstances, your flight insurance can help you recoup some or all of your costs. |

| Medical coverage | Flight insurance can help cover the costs of medical treatment if you become sick or injured during your trip. |

The Drawbacks of Flight Insurance with American Airlines

While there are benefits to purchasing flight insurance with American Airlines, there are also drawbacks to consider. First and foremost, flight insurance comes at a cost. Depending on the level of coverage you select, you may be paying a significant amount of money for your policy.

Another drawback to flight insurance is that it may not cover everything. There may be exclusions or limitations to your coverage, so it’s important to read the fine print before purchasing a policy. Additionally, some credit cards offer travel insurance as a perk, so you may already have coverage without realizing it.

List: Drawbacks of Flight Insurance with American Airlines

- Cost

- Exclusions or limitations to coverage

- Redundancy if you already have coverage through a credit card or other means

Conclusion: Is Flight Insurance Worth It with American Airlines?

Whether or not flight insurance is worth it with American Airlines ultimately depends on your individual circumstances. If you’re traveling internationally or have a high-cost trip planned, flight insurance can provide valuable peace of mind in case anything goes wrong. However, if you already have coverage through another source or are taking a low-cost trip, flight insurance may not be necessary. Be sure to weigh the costs and benefits before making a decision.

Frequently Asked Questions

Traveling can be unpredictable, and sometimes things happen that are beyond our control. That’s why American Airlines offers its customers the option to purchase flight insurance. Here are the most common questions customers ask about flight insurance.

What does American Airlines Flight Insurance cover?

American Airlines Flight Insurance provides coverage for trip cancellation, trip interruption, emergency medical and dental expenses, accidental death and dismemberment, and baggage protection. This coverage is designed to provide peace of mind to travelers who want to protect their investment in their trip.

It’s important to note that the coverage provided by American Airlines Flight Insurance is subject to the terms and conditions of the policy. Be sure to read the policy carefully and understand what is and isn’t covered before purchasing flight insurance.

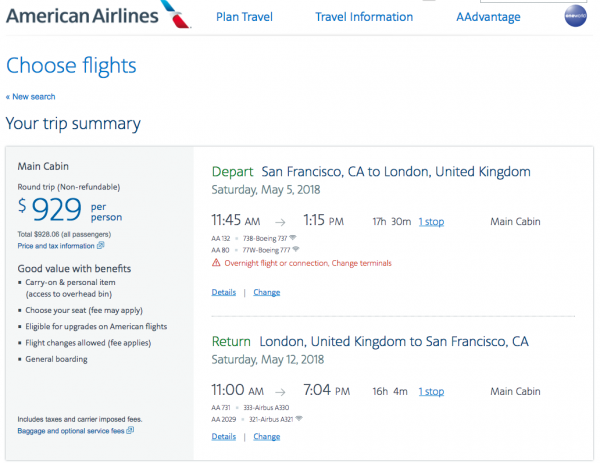

How much does American Airlines Flight Insurance cost?

The cost of American Airlines Flight Insurance varies depending on the cost of your trip and the type of coverage you choose. Typically, the cost is a percentage of the total cost of your trip. You can get a quote for flight insurance when you book your trip on the American Airlines website.

Keep in mind that flight insurance is an additional expense, and you’ll need to weigh the cost of the insurance against the potential benefits of having it. If you’re traveling with expensive luggage or have a medical condition that could require emergency care, flight insurance might be a wise investment.

Can I purchase American Airlines Flight Insurance after I’ve booked my trip?

Yes, you can purchase American Airlines Flight Insurance after you’ve booked your trip. However, it’s important to note that some coverages, such as trip cancellation, have time-sensitive requirements. Be sure to read the policy carefully and understand the requirements for each type of coverage.

If you decide to purchase flight insurance after you’ve booked your trip, you can do so by visiting the American Airlines website or by calling their customer service department.

What happens if I need to cancel my trip after purchasing American Airlines Flight Insurance?

If you need to cancel your trip after purchasing American Airlines Flight Insurance, you may be eligible for reimbursement of your non-refundable expenses. However, this depends on the reason for the cancellation and the type of coverage you have. Be sure to read the policy carefully and understand the requirements for trip cancellation coverage.

If you need to cancel your trip, you should contact American Airlines customer service as soon as possible. They can provide guidance on how to file a claim and what documentation you’ll need to provide.

Is American Airlines Flight Insurance worth it?

Whether or not American Airlines Flight Insurance is worth it depends on your individual circumstances. If you’re traveling with expensive luggage or have a medical condition that could require emergency care, flight insurance might be a wise investment. However, if you’re traveling on a budget and don’t have any special concerns, you may be able to skip flight insurance.

Ultimately, the decision to purchase American Airlines Flight Insurance is up to you. Be sure to weigh the cost of the insurance against the potential benefits and make an informed decision based on your individual circumstances.

In conclusion, the question of whether or not flight insurance is worth it when flying with American Airlines ultimately depends on your individual needs and circumstances. While it may provide peace of mind and financial protection if your flight is canceled or delayed, it is important to carefully consider the cost and coverage of the insurance before purchasing.

If you are a frequent traveler or have a connecting flight, flight insurance may be a wise investment to protect against unexpected events that could disrupt your travel plans. However, if you are flying on a direct flight and have flexibility in your travel itinerary, you may not need the added expense of flight insurance.

Ultimately, it is important to do your research and weigh the pros and cons before deciding whether or not to purchase flight insurance when flying with American Airlines. By taking the time to consider your options and make an informed decision, you can ensure a stress-free and enjoyable travel experience.