United Airlines, one of the world’s largest airlines, has had its ups and downs in recent years. From the infamous passenger incident in 2017 to the COVID-19 pandemic, the airline industry has faced many challenges. As a potential investor, you may be wondering if it’s a good time to buy United Airlines stock. In this article, we’ll explore the current state of United Airlines and whether it’s a wise investment decision.

Contents

- Is It Good to Buy United Airlines Stock?

- Frequently Asked Questions

- What are the factors that affect United Airlines stock price?

- What are the benefits of investing in United Airlines stock?

- What are the risks of investing in United Airlines stock?

- How can I evaluate whether United Airlines stock is a good investment?

- What is the outlook for United Airlines stock?

- United is still the best airline stock going into 2023, says Cowen’s Helane Becker

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Is It Good to Buy United Airlines Stock?

United Airlines, one of the largest airlines in the world, has been a popular investment choice for many investors. However, with the current state of the airline industry, many are questioning whether it is a good idea to invest in United Airlines stock. In this article, we will explore the pros and cons of investing in United Airlines and help you make an informed decision.

Pros of Investing in United Airlines Stock

United Airlines has been in business for over 90 years and has built a strong reputation in the airline industry. Despite the impact of the COVID-19 pandemic, United Airlines has been able to adapt to the changing market conditions and has taken measures to ensure the safety of its passengers. Here are some of the reasons why you might consider investing in United Airlines stock:

1. Strong Brand Name

United Airlines is a well-known brand in the airline industry and has a loyal customer base. This gives the company an advantage over its competitors and makes it more likely to bounce back from the impact of the pandemic.

2. Cost-Cutting Measures

United Airlines has taken measures to reduce costs in response to the pandemic, including reducing flights and cutting back on non-essential spending. This has helped the company to weather the storm and remain profitable.

Cons of Investing in United Airlines Stock

While there are some compelling reasons to invest in United Airlines stock, there are also some potential downsides to consider:

1. Uncertain Future

The airline industry is facing an uncertain future due to the ongoing impact of the pandemic. There is no guarantee that United Airlines will be able to recover fully from the current crisis, and there is a risk that the company may struggle in the long term.

2. Regulatory and Legal Issues

United Airlines has faced a number of regulatory and legal issues in recent years, including fines for safety violations and lawsuits related to passenger incidents. These issues can have a negative impact on the company’s reputation and financial performance.

United Airlines Stock Performance

If you are considering investing in United Airlines stock, it is important to understand how the company has performed in the past. Here are some key performance indicators to consider:

| Year | Revenue | Net Income |

|---|---|---|

| 2018 | $41.3 billion | $2.1 billion |

| 2019 | $43.3 billion | $3 billion |

| 2020 | $15.4 billion | -$7.1 billion |

As you can see, United Airlines has experienced a significant decline in revenue and net income in 2020 due to the pandemic. However, the company has remained profitable in previous years and has the potential to bounce back once the airline industry recovers.

Should You Invest in United Airlines Stock?

Investing in United Airlines stock is a personal decision that depends on your financial goals and risk tolerance. While there are some potential downsides to consider, there are also some compelling reasons to invest in the company. If you believe that United Airlines has the potential to recover from the impact of the pandemic and you are comfortable with the risks involved, investing in United Airlines stock could be a good choice for you. However, it is always important to do your own research and consult with a financial advisor before making any investment decisions.

Frequently Asked Questions

What are the factors that affect United Airlines stock price?

United Airlines stock price can be affected by various factors such as fuel prices, global economic conditions, competition, and geopolitical events. The company’s financial performance and management decisions can also impact the stock price.

It’s important to keep an eye on these factors and do thorough research before making any investment decisions to ensure that you’re making an informed choice.

What are the benefits of investing in United Airlines stock?

Investing in United Airlines stock can offer potential long-term benefits such as capital appreciation, dividend income, and a hedge against inflation. As one of the largest airlines in the world, United Airlines has a strong market position and brand recognition that can help sustain its growth over time.

However, it’s important to note that there are risks associated with investing in any stock, including United Airlines, and past performance is not a guarantee of future results.

What are the risks of investing in United Airlines stock?

Like any investment, United Airlines stock comes with risks. The airline industry is highly competitive and is subject to a variety of factors that can impact the company’s financial performance, including fuel prices, labor costs, and economic conditions.

Additionally, unforeseen events such as security threats, natural disasters, and pandemics can also have a significant impact on the airline industry as a whole and on United Airlines in particular.

How can I evaluate whether United Airlines stock is a good investment?

When evaluating United Airlines stock as an investment opportunity, it’s important to consider the company’s financial performance, management team, competitive position, and growth prospects. Analyzing financial statements, industry trends, and market conditions can also help determine whether the stock is undervalued or overvalued.

It’s important to do your own research and consult with a financial advisor before making any investment decisions.

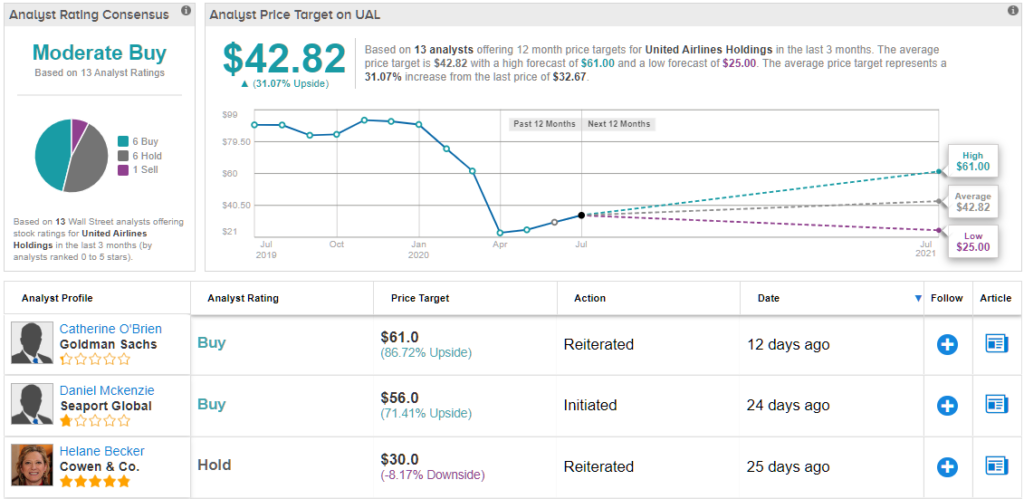

What is the outlook for United Airlines stock?

The outlook for United Airlines stock is subject to a variety of factors, including the airline industry’s overall performance, global economic conditions, and geopolitical events. While the industry has faced significant challenges in recent years, the long-term outlook for United Airlines remains positive due to its strong market position and brand recognition.

However, it’s important to keep an eye on industry trends and company performance to stay informed about any changes that may impact the stock’s future outlook.

United is still the best airline stock going into 2023, says Cowen’s Helane Becker

In conclusion, deciding whether to buy United Airlines stock is a complex decision that requires careful consideration of various factors. On the one hand, the airline industry has been hit hard by the COVID-19 pandemic, and United Airlines is no exception. However, the company has taken steps to mitigate the impact of the crisis and position itself for long-term success.

On the other hand, investing in United Airlines stock could provide an opportunity for growth and potential returns, especially if the airline industry rebounds as the pandemic subsides. Additionally, United Airlines has a strong reputation and a loyal customer base, which could bode well for its future prospects.

Ultimately, whether or not to buy United Airlines stock depends on your personal financial goals and risk tolerance. It’s important to do your own research and consult with a financial advisor before making any investment decisions.