United Airlines has been a well-known name in the aviation industry for decades. With the pandemic hitting hard, the airline industry has taken a huge hit, leaving investors wondering if United Airlines stock is worth their investment. As the world is slowly recovering from the pandemic, investors are curious to know if a buy in United Airlines stock could potentially yield high returns. In this article, we’ll take a closer look at the current state of United Airlines and determine whether or not it’s a good buy in the current market conditions.

Contents

- Is United Airlines Stock a Buy Right Now?

- Frequently Asked Questions

- What are the factors to consider before buying United Airlines stock?

- What are the advantages of buying United Airlines stock?

- What are the risks of buying United Airlines stock?

- What is the current performance of United Airlines stock?

- What is the outlook for United Airlines stock?

- United is still the best airline stock going into 2023, says Cowen’s Helane Becker

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Is United Airlines Stock a Buy Right Now?

If you are considering investing in the airline industry, you may be wondering if United Airlines stock is a good choice. United Airlines is one of the largest airlines in the world and has a strong presence in both domestic and international markets. However, like many other airlines, United Airlines has faced challenges in recent years, including rising fuel costs, increased competition, and the impact of the COVID-19 pandemic. In this article, we will take a closer look at United Airlines stock and whether it is a buy right now.

Financial Performance

United Airlines has experienced significant financial challenges in recent years, including a decline in revenue and profitability. In 2019, the company reported revenue of $43.2 billion, a decrease of 1.7% from the previous year. Additionally, the company reported a net loss of $1.7 billion in 2019, compared to net income of $2.3 billion in 2018. However, the company has taken steps to improve its financial performance, including reducing costs and increasing efficiency. In the first quarter of 2021, United Airlines reported a net loss of $1.36 billion, but the company expects to return to profitability later in the year.

In terms of valuation, United Airlines stock currently trades at a price-to-earnings ratio of 9.4, which is lower than the industry average of 12.5. This suggests that the stock may be undervalued compared to its peers.

Industry and Competitive Landscape

The airline industry is highly competitive, with numerous airlines vying for market share. United Airlines competes with other major carriers such as Delta Air Lines and American Airlines, as well as low-cost carriers such as Southwest Airlines and Spirit Airlines. The industry is also subject to regulatory scrutiny and is heavily influenced by factors such as fuel prices, global economic conditions, and travel restrictions.

Despite these challenges, United Airlines has several competitive advantages. The company has a strong network of routes and destinations, including a significant presence in Asia and Latin America. Additionally, the company has invested in technology and customer service initiatives to improve the travel experience for passengers.

Pros of Investing in United Airlines Stock

There are several potential benefits to investing in United Airlines stock. First, the company has a strong market position and is well-positioned for growth as the global economy recovers from the COVID-19 pandemic. Additionally, the company has taken steps to improve its financial performance, including reducing costs and increasing efficiency. Finally, the stock may be undervalued compared to its peers, providing an opportunity for investors to buy in at a lower price.

Cons of Investing in United Airlines Stock

There are also several potential risks associated with investing in United Airlines stock. First, the airline industry is highly competitive and subject to regulatory scrutiny, which could impact the company’s financial performance. Additionally, the company is heavily influenced by external factors such as fuel prices and global economic conditions, which are difficult to predict. Finally, the COVID-19 pandemic has had a significant impact on the airline industry, and it is unclear how long it will take for air travel to fully recover.

Conclusion

In conclusion, United Airlines is a major player in the airline industry and has several competitive advantages, including a strong network of routes and destinations and a focus on customer service and technology. While the company has faced financial challenges in recent years, it has taken steps to improve its performance and is well-positioned for growth as the global economy recovers from the COVID-19 pandemic. However, there are also potential risks associated with investing in United Airlines stock, including industry competition and external factors such as fuel prices and global economic conditions. Ultimately, investors should carefully consider these factors before making a decision to invest in United Airlines stock.

Frequently Asked Questions

What are the factors to consider before buying United Airlines stock?

Before buying United Airlines stock, it is important to consider various factors. Firstly, analyze the company’s financial performance, including revenue, profit margins, and debt levels. Secondly, assess the airline industry’s current and future outlook, including the impact of COVID-19 on the industry. Thirdly, understand the competitive landscape and United Airlines’ market share. Finally, consider the company’s future growth prospects, including expansion plans and new routes.

What are the advantages of buying United Airlines stock?

Buying United Airlines stock has several advantages. Firstly, the airline industry is expected to recover as the COVID-19 vaccine rollout continues. Secondly, United Airlines has a strong market position and brand recognition. Thirdly, the company has a solid financial position, with a healthy balance sheet and liquidity. Finally, United Airlines has a strong track record of innovation and investment in technology, which could drive future growth.

What are the risks of buying United Airlines stock?

There are several risks associated with buying United Airlines stock. Firstly, the airline industry is highly competitive, and United Airlines faces competition from other airlines and transportation methods. Secondly, the COVID-19 pandemic has severely impacted the airline industry, and it is uncertain how long it will take for a full recovery. Thirdly, United Airlines has a high debt load, which could impact its financial performance and ability to invest in future growth. Finally, geopolitical risks, such as trade disputes and political instability, could impact the airline industry and United Airlines.

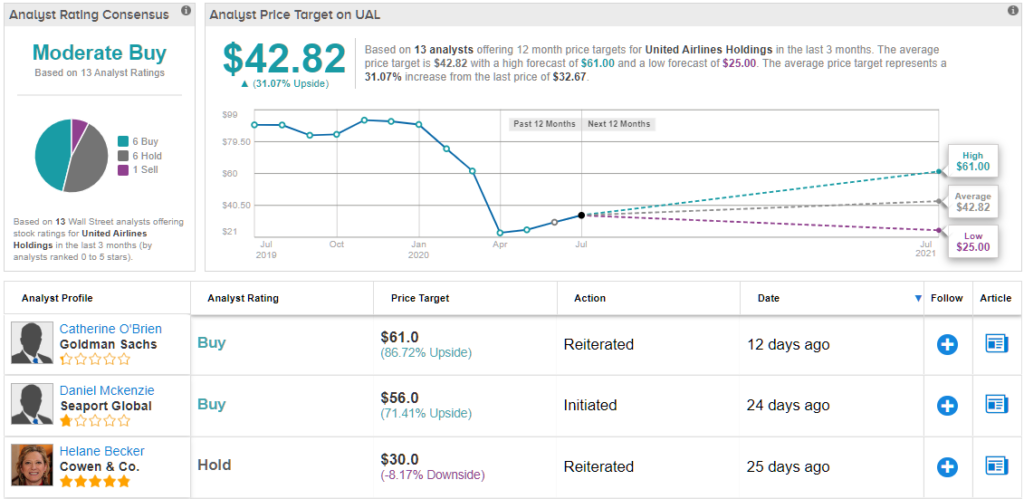

What is the current performance of United Airlines stock?

As of September 2021, United Airlines stock has seen a gradual recovery from the impact of the COVID-19 pandemic. The stock is currently trading at around $47 per share, up from a low of $17.80 in March 2020. However, the stock is still below pre-pandemic levels, which were around $90 per share in February 2020.

What is the outlook for United Airlines stock?

The outlook for United Airlines stock is positive, but it is important to consider the risks and uncertainties associated with the airline industry. The company has a strong market position and brand recognition, and the airline industry is expected to recover as the COVID-19 vaccine rollout continues. However, there are risks associated with competition, debt levels, and geopolitical risks. As such, potential investors should conduct thorough research and analysis before making a decision to buy United Airlines stock.

United is still the best airline stock going into 2023, says Cowen’s Helane Becker

In conclusion, the decision to invest in United Airlines stock ultimately depends on one’s tolerance for risk and overall investment strategy. While the airline industry has undoubtedly been impacted by the COVID-19 pandemic, United Airlines has taken steps to mitigate its losses and position itself for a strong recovery.

Investors should consider United Airlines’ financial stability, including its cash reserves and debt, as well as the potential for increased demand for travel as vaccinations become more widespread and travel restrictions ease. Additionally, the company’s commitment to sustainability and innovation may make it an attractive long-term investment.

However, it is important to note that the airline industry remains unpredictable and subject to external factors such as global events and economic downturns. As with any investment, thorough research and a diversified portfolio are key to managing risk and achieving financial goals.