Traveling can be exciting, but it can also come with its fair share of uncertainties. That’s why United Airlines offers insurance coverage to its passengers. But what does this insurance cover exactly? Let’s dive in and explore the details of United Airlines’ insurance coverage.

From flight cancellations to lost luggage, United Airlines’ insurance coverage offers peace of mind to travelers. But with various options available, it’s important to understand what each one covers and how it can benefit you. In this article, we’ll break down the different insurance options provided by United Airlines and help you make an informed decision for your next trip.

Contents

- United Airlines Insurance Coverage: Everything You Need to Know

- Frequently Asked Questions

- Does United Airlines offer travel insurance?

- What does United Airlines trip cancellation insurance cover?

- Does United Airlines insurance cover trip interruption?

- What does United Airlines emergency medical insurance cover?

- Does United Airlines insurance cover lost baggage?

- Is United Airlines Travel Insurance Worth Buying – AARDY

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

United Airlines Insurance Coverage: Everything You Need to Know

If you’re planning a trip with United Airlines, you might be wondering what kind of insurance coverage they offer. In this article, we’ll take a closer look at United Airlines’ insurance policies, what they cover, and what you need to know before you book your flight.

Types of Insurance Coverage Offered by United Airlines

United Airlines offers several types of insurance coverage to help protect you during your travels. These include:

1. Trip Cancellation/Interruption Insurance

This insurance covers you in case you need to cancel or interrupt your trip due to unforeseen circumstances such as illness, injury, or a death in the family. It can also cover you if your flight is cancelled or delayed for a covered reason.

If you have to cancel your trip, you’ll be reimbursed for any non-refundable expenses such as airfare, hotel reservations, and tours. If your trip is interrupted, you’ll be reimbursed for any unused portion of your trip.

2. Baggage Insurance

This insurance covers you in case your baggage is lost, stolen, or damaged during your trip. If your baggage is lost or stolen, you’ll be reimbursed for the value of your items up to a certain dollar amount. If your baggage is damaged, you’ll be reimbursed for the repair or replacement cost.

3. Travel Accident Insurance

This insurance provides coverage in case you or a covered family member is injured or killed during your trip. You’ll be reimbursed for medical expenses, evacuation expenses, and accidental death and dismemberment benefits.

Benefits of United Airlines Insurance Coverage

There are several benefits to purchasing insurance coverage from United Airlines, including:

1. Peace of Mind

By purchasing insurance coverage, you can travel with peace of mind knowing that you’re protected in case something goes wrong during your trip.

2. Financial Protection

If you need to cancel your trip or your baggage is lost or stolen, insurance coverage can help protect your finances by reimbursing you for any non-refundable expenses or the value of your lost or stolen items.

3. Convenience

United Airlines’ insurance coverage is easy to purchase and can be added to your flight reservation during the booking process.

United Airlines Insurance Coverage vs. Other Options

When it comes to travel insurance, there are many options to choose from. Here’s how United Airlines’ insurance coverage stacks up against other options:

1. Credit Card Travel Insurance

Many credit cards offer travel insurance as a perk, but the coverage can vary widely depending on the card. United Airlines’ insurance coverage is more comprehensive and tailored to your specific travel needs.

2. Third-Party Travel Insurance

Third-party travel insurance providers offer a wide range of coverage options, but they can be more expensive than United Airlines’ insurance coverage. Plus, United Airlines’ insurance coverage is convenient and easy to purchase.

3. No Insurance Coverage

If you don’t purchase insurance coverage, you run the risk of losing money if you need to cancel your trip or if your baggage is lost or stolen. United Airlines’ insurance coverage provides peace of mind and financial protection.

Conclusion

Overall, United Airlines’ insurance coverage provides comprehensive protection for your travels. By purchasing insurance coverage, you can travel with peace of mind knowing that you’re protected in case something goes wrong. Plus, United Airlines’ insurance coverage is convenient and easy to purchase.

Frequently Asked Questions

Here are some common questions related to United Airlines insurance coverage:

Does United Airlines offer travel insurance?

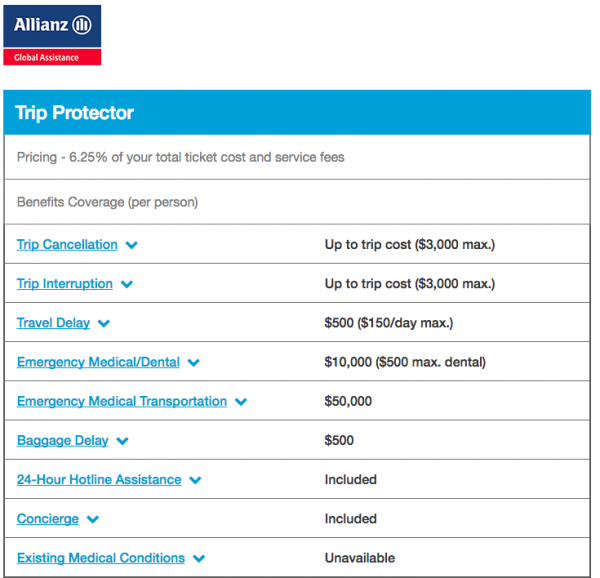

Yes, United Airlines offers travel insurance to its customers. This insurance covers various aspects of travel, such as trip cancellation, trip interruption, emergency medical and dental expenses, baggage loss, and more. With United Airlines insurance, you can travel with peace of mind knowing that you are protected against a range of unforeseen circumstances.

It’s important to note that the coverage and benefits of United Airlines insurance may vary depending on the plan you choose. You should carefully review the terms and conditions of the policy before purchasing it to ensure that it meets your specific needs.

What does United Airlines trip cancellation insurance cover?

United Airlines trip cancellation insurance provides coverage if you need to cancel your trip due to unforeseen circumstances, such as illness, injury, or death of a family member. This insurance can also cover trip cancellation due to severe weather, natural disasters, or other unexpected events.

The exact coverage and benefits of United Airlines trip cancellation insurance may vary depending on the plan you choose. However, in general, this insurance can reimburse you for the non-refundable portion of your trip expenses, such as airfare, hotel, and tour costs.

Does United Airlines insurance cover trip interruption?

Yes, United Airlines insurance covers trip interruption in the event that your trip is interrupted or cut short due to unforeseen circumstances. This insurance can provide coverage if you need to return home early due to illness, injury, or death of a family member, or if your travel plans are disrupted due to severe weather or natural disasters.

The coverage and benefits of United Airlines trip interruption insurance may vary depending on the plan you choose. You should carefully review the terms and conditions of the policy before purchasing it to ensure that it meets your specific needs.

What does United Airlines emergency medical insurance cover?

United Airlines emergency medical insurance provides coverage for medical and dental emergencies that occur while you are traveling. This insurance can cover expenses such as hospitalization, surgery, ambulance services, and prescription medications.

The exact coverage and benefits of United Airlines emergency medical insurance may vary depending on the plan you choose. However, in general, this insurance can provide you with peace of mind knowing that you are covered in the event of a medical emergency while traveling.

Does United Airlines insurance cover lost baggage?

Yes, United Airlines insurance covers lost baggage if your checked baggage is lost, stolen, or damaged during your trip. This insurance can provide reimbursement for the value of your lost or damaged items up to a certain limit.

The coverage and benefits of United Airlines lost baggage insurance may vary depending on the plan you choose. You should carefully review the terms and conditions of the policy before purchasing it to ensure that it meets your specific needs.

Is United Airlines Travel Insurance Worth Buying – AARDY

In conclusion, United Airlines offers comprehensive travel insurance coverage to its customers. The insurance policies cover a wide range of potential risks and mishaps that a traveler may encounter during their trip. From trip cancellations to medical emergencies and baggage loss, United Airlines insurance has got you covered.

Moreover, United Airlines insurance is easy to purchase and is available online. Customers can choose from a variety of insurance plans based on their individual needs and preferences. The insurance policies are competitively priced and offer excellent value for money.

Overall, purchasing United Airlines insurance is a smart choice for any traveler. It provides a sense of security and peace of mind that is invaluable when traveling, especially during uncertain times. So, next time you plan your trip, be sure to consider purchasing United Airlines insurance for a worry-free and enjoyable journey.