Are you planning a trip with United Airlines? Travel insurance can be a great investment to protect your trip and give you peace of mind. But what exactly does United Airlines travel insurance cover? In this article, we’ll break down the coverage options offered by United Airlines and help you decide if it’s the right option for your next journey.

Contents

- Understanding United Airlines Travel Insurance Coverage

- Flight Cancellation or Delay Coverage

- Baggage Delay or Loss Coverage

- Medical Coverage

- Accidental Death and Dismemberment Coverage

- 24-hour Travel Assistance

- Benefits of United Airlines Travel Insurance

- Drawbacks of United Airlines Travel Insurance

- United Airlines Travel Insurance vs. Other Travel Insurance Options

- Conclusion

- Frequently Asked Questions

- Does United Airlines travel insurance cover trip cancellation?

- Does United Airlines travel insurance cover medical expenses?

- Does United Airlines travel insurance cover lost or delayed baggage?

- Does United Airlines travel insurance cover trip interruption?

- Does United Airlines travel insurance cover rental car damage?

- Travel insurance: What it covers, what it doesn’t

- What Is United Airlines Slogan?

- The Top 5 Destinations To Explore With United Airlines

- What Are United Regional Airlines?

Understanding United Airlines Travel Insurance Coverage

United Airlines is one of the world’s largest airlines, offering travel insurance to its passengers. The airline’s travel insurance coverage is an optional add-on that provides a range of benefits to ensure that travelers are protected in the event of an unexpected event. This article will take a closer look at what United Airlines travel insurance covers.

Flight Cancellation or Delay Coverage

Flight delays and cancellations can happen to anyone, anytime, anywhere. United Airlines travel insurance covers flight cancellations and delays due to weather, mechanical breakdown, or other covered reasons. The coverage provides reimbursement for expenses incurred due to the delay or cancellation, such as meals, hotel accommodations, and transportation. The coverage amount depends on the severity of the delay or cancellation.

In addition, United Airlines travel insurance coverage provides reimbursement for non-refundable expenses if the flight is canceled due to a covered reason. This includes expenses such as prepaid hotel reservations, tours, and activities. The coverage amount varies based on the cost of the non-refundable expenses.

Baggage Delay or Loss Coverage

Baggage delay or loss can be a frustrating experience for any traveler. United Airlines travel insurance covers baggage delay or loss due to theft, damage, or misdirection. The coverage provides reimbursement for expenses incurred due to the delay or loss, such as clothing, toiletries, and other essential items. The coverage amount varies based on the severity of the delay or loss.

In addition, United Airlines travel insurance coverage provides reimbursement for the purchase of necessary personal items if the baggage is delayed for a certain amount of time. The coverage amount varies based on the duration of the delay.

Medical Coverage

Medical emergencies can happen at any time and can be expensive when traveling abroad. United Airlines travel insurance covers medical expenses incurred due to an illness or injury that occurs while traveling. The coverage provides reimbursement for medical expenses such as hospitalization, doctor’s fees, and prescription drugs. The coverage amount varies based on the severity of the illness or injury.

In addition, United Airlines travel insurance coverage provides emergency medical evacuation coverage in case of a life-threatening medical situation. The coverage amount varies based on the cost of the evacuation.

Accidental Death and Dismemberment Coverage

United Airlines travel insurance provides accidental death and dismemberment coverage, which pays a benefit if the insured person dies or suffers a loss of limb or eyesight due to an accident that occurs while traveling. The coverage amount varies based on the severity of the loss.

24-hour Travel Assistance

United Airlines travel insurance provides 24-hour travel assistance to help travelers with emergencies or unexpected events while traveling. The assistance includes services such as emergency medical assistance, emergency travel arrangements, and lost passport or travel document assistance.

In addition, United Airlines travel insurance provides concierge services to help travelers with non-emergency travel needs, such as restaurant reservations, entertainment tickets, and transportation arrangements.

Benefits of United Airlines Travel Insurance

United Airlines travel insurance provides peace of mind to travelers, knowing that they are protected in case of an unexpected event. The coverage provides reimbursement for expenses incurred due to flight cancellations or delays, baggage delay or loss, medical emergencies, and accidental death or dismemberment. In addition, the 24-hour travel assistance and concierge services provide support and convenience to travelers.

Drawbacks of United Airlines Travel Insurance

The main drawback of United Airlines travel insurance is that it is an optional add-on that increases the cost of the ticket. In addition, the coverage limits may not be sufficient for travelers with high-value belongings or medical needs. Before purchasing United Airlines travel insurance, travelers should carefully review the coverage details and compare them to other travel insurance options to ensure they are getting the best value for their money.

United Airlines Travel Insurance vs. Other Travel Insurance Options

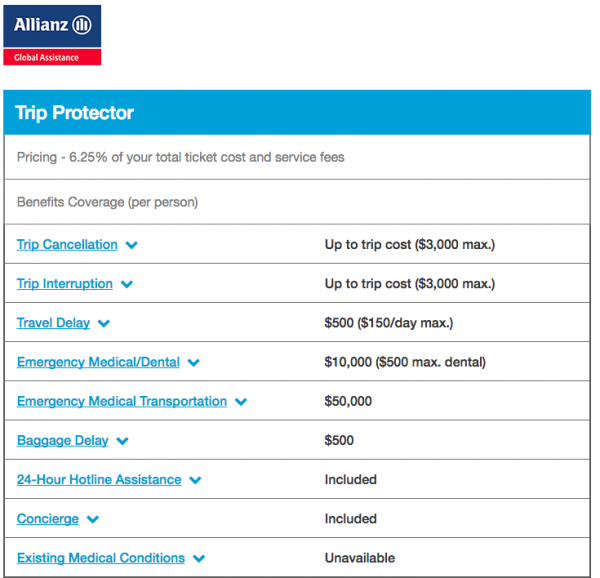

United Airlines travel insurance is just one option for travelers to consider when purchasing travel insurance. Other travel insurance options include travel insurance providers such as Allianz, AXA, and World Nomads. Travelers should compare the coverage details, cost, and reputation of each provider before purchasing travel insurance to ensure they are getting the best value for their money.

Conclusion

United Airlines travel insurance is an optional add-on that provides a range of benefits to ensure that travelers are protected in case of an unexpected event. The coverage includes flight cancellation or delay coverage, baggage delay or loss coverage, medical coverage, accidental death and dismemberment coverage, and 24-hour travel assistance. While United Airlines travel insurance may not be the best option for all travelers, it provides peace of mind and convenience to those who choose to purchase it.

Frequently Asked Questions

Here are some common questions about United Airlines travel insurance:

Does United Airlines travel insurance cover trip cancellation?

Yes, United Airlines travel insurance can cover trip cancellation due to unforeseen circumstances such as illness, injury, or death of the traveler or a family member, severe weather conditions, or other unexpected events covered by the policy. However, the specific reasons covered may vary depending on the policy and level of coverage selected.

It is important to review the policy details carefully before purchasing travel insurance to understand the specific circumstances that are covered and any exclusions or limitations that may apply.

Does United Airlines travel insurance cover medical expenses?

Yes, United Airlines travel insurance can cover medical expenses incurred during travel due to illness or injury, up to the limit specified in the policy. This can include emergency medical treatment, hospitalization, and other related expenses. However, pre-existing medical conditions may not be covered, and some policies may have restrictions on coverage for specific activities or destinations.

It is important to review the policy details carefully before purchasing travel insurance to understand the specific coverage for medical expenses, including any deductibles or limits that may apply.

Does United Airlines travel insurance cover lost or delayed baggage?

Yes, United Airlines travel insurance can cover lost or delayed baggage during travel, up to the limit specified in the policy. This can include reimbursement for essential items purchased due to delayed baggage, as well as compensation for lost or damaged luggage. However, some policies may have restrictions on coverage for high-value items or specific types of baggage.

It is important to review the policy details carefully before purchasing travel insurance to understand the specific coverage for lost or delayed baggage, including any deductibles or limits that may apply.

Does United Airlines travel insurance cover trip interruption?

Yes, United Airlines travel insurance can cover trip interruption due to unforeseen circumstances such as illness, injury, or death of the traveler or a family member, severe weather conditions, or other unexpected events covered by the policy. This can include reimbursement for unused travel arrangements and additional expenses incurred due to the interruption. However, the specific reasons covered may vary depending on the policy and level of coverage selected.

It is important to review the policy details carefully before purchasing travel insurance to understand the specific circumstances that are covered and any exclusions or limitations that may apply.

Does United Airlines travel insurance cover rental car damage?

Yes, United Airlines travel insurance can cover rental car damage during travel, up to the limit specified in the policy. This can include reimbursement for repair or replacement of a rental car damaged due to accident, theft, or other covered events. However, some policies may have restrictions on coverage for specific types of rental cars or activities.

It is important to review the policy details carefully before purchasing travel insurance to understand the specific coverage for rental car damage, including any deductibles or limits that may apply.

Travel insurance: What it covers, what it doesn’t

In conclusion, United Airlines travel insurance can be a great option if you’re looking for some extra peace of mind when traveling. With coverage for trip cancellation and interruption, emergency medical and dental expenses, and baggage loss or delay, you can rest assured that you’re protected against unexpected events that could derail your trip.

It’s important to note that the coverage offered by United Airlines travel insurance can vary depending on the plan you choose. Make sure to read the details carefully and understand what is and isn’t covered before purchasing a policy.

Overall, if you’re planning a trip and want to protect your investment, United Airlines travel insurance is definitely worth considering. With affordable rates and comprehensive coverage options, it’s a smart way to ensure that you’re protected against the unexpected and can enjoy your travels with peace of mind.